Discussion between a used car dealer and a lawyer.

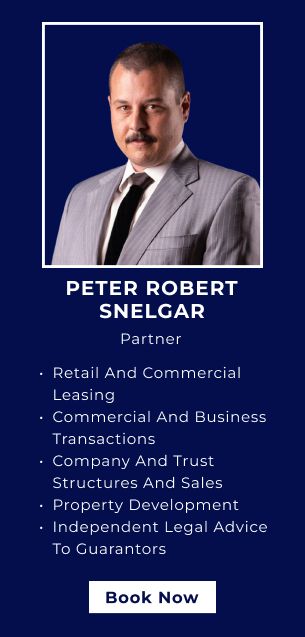

Yusuke Soda and Jake Jeong

Due to its vast territory, Australia is basically a car-based society. People who live in cities may not be particularly conscious of it, but once you leave the city, there are many places you can't go without a car, and a car becomes a necessity. As a result, there is active buying and selling of used cars in Australia at prices that are affordable for working holidaymakers and students. This article introduces Yusuke Soda, the representative of WISE JAPAN, which has its main office on the Gold Coast and has an overwhelming presence as a used car dealer, and Jake Jeong, of CJM Lawyers, a law firm with four offices in QLD and NSW, who talked about the pitfalls of private car sales and the reason for the existence of dealers, including the laws related to used car transactions and how to avoid problems.

What are the benefits and risks of privately selling used cars?

While new car sales are rapidly increasing in Australia, the market is declining as used cars, which had been selling well due to replacement demand for new cars, are becoming duplicated, especially older models. As prices continue to drop and it becomes easier to purchase, private sales of used cars tend to become more active.

What do you think?

Yusuke Soda: Don't forget that there are risks associated with individual buying and selling. The higher the risk, the cheaper you can get a car, and the more you spend, the lower the risk.

Jake Jeong: Of course, buying a used car through a dealer is more expensive than buying it privately, but there are obvious reasons why. One of the things that you can do is confirm that the car is sound and safe, including the registration and certificates that are essential when owning a car, the preparation of necessary documents that must be submitted to the government, and mechanical aspects.

Yusuke Soda: When you buy a car from a dealer, safety is guaranteed, so you can ask for help if it breaks down or an accident occurs. The biggest legal difference is whether or not there is a warranty. A common pattern in private sales is that you may find out after the purchase that there was an accident in the past or that the car was stolen. You are obligated to inform the purchaser. In the case of privately sold cars, there is a risk of various problems such as the accident history not being known, and odometer and registration fraud. However, dealers are subject to regulations, so they must not only inform the buyer of the accident history, but also take care of warranty and insurance procedures.

Jake Jeong: Many people don't know information about warranties. Some people, especially those who come to Australia from overseas, don't know whether they need insurance or not and think they don't need it. Meanwhile, dealers provide support by providing important information, including insurance, in addition to the car itself. In the case of a private sale, there is no traceability history or guarantee, such as whether the car is stolen, and everything must be confirmed by the individual. Many foreigners, including Japanese, don't know how to get verified in Australia. For example, if your car has a personal loan on it, you won't legally have the power to take it away, but you could be subject to a claim. There have been many cases where a car that was being financed was sold and its registration was on PPSR, but because the car was sold privately, the car was not known, and the car was repossessed by the bank after the car was acquired.

Yusuke Soda: Certainly. I hear stories like that often.

Jake Jeong: Sometimes it's a stolen car. For example, if your car was stolen the day before you bought it, it may not show up in your car history right away. There is also the risk of being involved in a crime, such as when a car is bought or sold during a police investigation, and after you buy it at a low price, the police investigate and say, ”This is the car you stole.'' In the case of private sales, such risks are extremely high. Since buying a car is a big purchase, it's easy to get careless if you only focus on the low price. It is important to consider carefully, including the level of risk.

Yusuke Soda: I think there are quite a few people who know a lot about cars who think they should just look for one and buy it themselves, but there are people who have a background as mechanics or who worked for an automaker. People who really understand cars buy cars through official shops and dealers. Cars are machines, so they will break down at some point and it will cost money to repair them. This is because we fully understand this. If you buy from a dealer, you have someone to complain to if something goes wrong with your car. If your car breaks down or you're in an accident, you can call your dealer and get help. No matter how much you know about cars, it is difficult to know about insurance, registration, accident history, theft history, etc., so it may be natural for even people who know a lot about cars to think about buying from a dealer.

Jake Jeong: When you buy from a dealer, you get a legal warranty, right? For example, if a used car is 10 years old and has a mileage of 160,000 km or more, there is a one-month warranty period, and if it is less than 10 years old and has a mileage of less than 160,000 km, it will come with a 3-month warranty.

Yusuke Soda: Even if a dealer says they offer a one-year warranty, in reality, the legal guarantee is at most three months for used cars. Many people have this misunderstanding, but even though it says a one-year warranty, it only covers the automatic engine and does not cover everything else, so you need to look carefully at the warranty details.

Jake Jeong: One of the most common incidents recently in private car sales is scams. Specifically, this applies to advertisements posted on the Internet, such as SNS timelines. There are plenty of photos and information about the car, and the link looks legitimate at first glance. After that, when I contacted them, I was asked to pay a deposit before inspecting the car, and after I paid the money, the advertisement disappeared and I was unable to contact the poster.

Yusuke Soda: Most of the people who fall for such scams, such as car and rent bonds, are foreigners. When it comes to cars, be careful about extremely cheap cars. For example, a very new car costs $5,000. Anyone who has lived in Australia with common sense would know that it's strange that a car is being sold at that price, but since they just arrived in Australia and don't speak much English, they just jumped at it because it was a cheap and good car. I transfer the money I have on hand. We also receive inquiries from customers who say that their car broke on the way home after they bought it, or that the engine won't start the next day. There are some small tricks that can be used to keep a worn-out car running for a day or a week. In that case, you would end up buying a piece of scrap metal for $5,000.

Jake Jeong: In the case of scams, there are many cases where you don't know who the recipient is and only know their phone number. Anyone can easily create a Facebook profile, so you should be careful.

Yusuke Soda: There's nothing you can do about it even if you report it to the police, so the only thing you can do is make sure you don't get caught in the first place. To do this, you need the right knowledge, and even if you have that knowledge, there will still be risks, so it's best not to cross dangerous bridges in the first place. I think it's fine to buy and sell cars between people with clear identities, such as good friends, but since there's no dealer in between, if something happens, both parties will be responsible. For example, if something goes wrong with your car, you could have had it fixed for free if you had bought it at a dealer, but because you bought it from a friend, it might cost you $5,000 to fix it. Even in cases where the seller was not expecting this or the buyer had heard that it was a decent car, problems still occur. Also, if the car is too worn out, it may not pass vehicle inspection, and there are some cases where the name cannot be changed. The cheaper the car, the more problems there are.

How can I avoid risks and purchase a used car with peace of mind?

Jake Jeong: When you buy a car privately, you are responsible. You are responsible for everything, including whether you have financing or if there is a problem with your car. Dealers are professionals who also know legal matters related to cars. You can avoid trouble by consulting with your dealer from the beginning, but if you do get into trouble, it would be a good idea to consult a lawyer.

Yusuke Soda: When you buy a car from a dealer, the law comes with a warranty for a certain period of time. At WISE JAPAN, we provide support even if a problem that is not covered by the warranty occurs. We're in business with a signboard, so we do everything we can to support the customers who buy from us. As for warranties, some people offer extended warranties for two years, for example, but that is a product sold as a package. Apart from that, there is a warranty that you must attach as a dealer, and it is divided into two patterns. For older cars that are more than 10 years old and have driven more than 160,000 km, the period is 1 month, and for other cars it is 3 months. Also, we only sell Japanese cars, so that may be another difference between us and other companies.

Jake Jeong: I think you should leave it to a dealer who is familiar with the Australian system. Many people from overseas think that the compulsory insurance on the register covers everything, but it does not cover damage to third parties or damage to assets. That's why I think it's important to get proper information and get insurance.

The important thing is to find out if the dealer is reliable.

Yusuke Soda: The scariest thing is unlicensed people pretending to be dealers. There are actually people who call themselves dealers and do business without a license. There are no guarantees if something happens, so if you run away, it's over. A car is a big machine, but unlike a house, it's surprisingly easy to buy if you save up money. That is why it is important to determine the means of purchase.

Jake Jeong: Even new cars can have problems, so you should be more careful when buying a used car.

Yusuke Soda: What's important is not what model year and car you buy, but where you buy it from. What is important is whether the person you gave the money to will treat you properly even after receiving the money. The key to finding a reliable dealer is whether or not they have a dealer license and a store. Although this is a special case, there are some individuals who simply obtain a license and set up a shop at home. Unlike underground dealers, these dealers are individual dealers, but since they don't have a store, they buy one car on their own, make a small profit, and then sell the car. Therefore, if we decide to issue a warranty, we will not be able to respond if three vehicles arrive at the same time. Another concern is that they don't have the financial strength because they don't have a store. In addition, people who are called black dealers, behind-the-scenes dealers, and backyard dealers do not have licenses or maintenance facilities. Their common pattern is to use someone else's name and sell from someone else's name to someone else's name.

Jake Jeong: To find out, first ask if they have a dealer license. There is a register for each state in Australia, so there is a way to check, and if you do a little research you can find the information. You can tell that the dealer is a legitimate dealer if they have a website, are doing proper marketing, and can check all the information on the register.

Yusuke Soda: Even though they know it's suspicious, there are many people who take advantage of the low price and buy it, but once the car stops working, it's over. I would like you to think carefully and consider the future, rather than jumping in just because it's cheap.

──Thank you very much for today.

Wise Japan

Yusuke Soda

Born in 1993 in Fukuoka Prefecture. Former professional magician. he is an entrepreneur. My hobby is surfing. He started doing magic when he was in elementary school, and while he was in college, he opened his own shop and became a professional magician. After that, he became an entrepreneur and over 11 years was involved in the launch of 9 companies and 13 stores, including a security system company, a purchasing specialty store, and WISE JAPAN, with total sales of 2.1 billion yen. He comes to work every day with his beloved Dalmatian, Pop, who is 3 years old.

CJM LAWYERS

Jake Jeong

Graduated from the Faculty of Law at Bond University. He is admitted to the NSW Supreme Court and the High Court of Australia. He handles a wide range of areas including general civil matters, immigration law, corporate law, family, property, wills and estate. He is fluent in English, Japanese, and Korean, and obtained a score of 90 on the PTE academic exam (equivalent to IELTS 9.0). He has four years of experience as a director of a consulting company related to nursing care. Member of the NSW Law Society, Gold Coast Japanese Chamber of Commerce and Industry, Asian Australian Lawyers Association, etc.

*The information contained in this article provides a general overview of matters of interest and is intended to apply within Australia only. Additionally, CJM Lawyers is not affiliated with Wise Japan Auto Group or Nichigo Press and remain impartial to provide the best possible service to our clients.